Covid-19

The IPPVA and their members are committed to the safety and wellbeing of their staff, colleagues and clients. In order to work safely during Covid-19 and ensure compliance with Government Directives, our members have been advised to implement their own Covid-19 risk assessment and Business Covid 19 Response Plan.

All IPPVA members have been given access to an instructional document which details how they can prepare their Covid risk assessment and their Covid Work Safely Business Plan. This guide also includes links to the Government Work Safely Protocol, HSA Covid checklists and HSA online certified courses members can complete.

As individual businesses, our members have an individual responsibility to risk assess and put their controls and procedures in place to protect themselves, their colleagues and their clients. The IPPVA cannot give permission for any member to return to work as the scenarios in which you all work differ from business to business.

We would recommend that all members use these resources and review their risk assessment and business plan every time the Government determines there will be a change in restrictions. All members should be able to use their risk assessments which are based on the scenarios they operate under to decide whether or not they can operate under current restrictions safely. They can then inform their clients of their decision and avoid unnecessary confusion as to whether they will remain open or close for the required period.

This advice to IPPVA members is in line with the Minister for Business Enterprise and Innovation, Ms. Heather Humphreys’ reply in May 2020 to the IPPVA

“Businesses should review this Roadmap carefully and decide for themselves which phase of reopening applies to them. It is not necessary to seek official authorisation.

Regardless of where a business assesses its position on the roadmap, it must also assess its ability to comply with continued public health requirements.“

The following resources are available to IPPVA members to complete their own risk assessments and make an informed decision. These were put together with the help of Coalesce (a collaborative group of photography and video businesses).

If you are an IPPVA member, check the private Facebook group’s announcements for a direct link.

Non-members can also receive a direct link to the resources by signing up to the IPPVA newsletter using this form:

The IPPVA and Covid-19 in 2020

While IPPVA members assess their own businesses, the IPPVA will continue to try and highlight your position as business owners and the impact Covid-19 is having on our industry. As we cannot do spot checks for non-compliances on all your business we cannot lobby the Government and claim we can guarantee all our business members are compliant with public health requirements. Therefore we will continue to keep the industry’s issues to the forefront of local and national Government as best we can.

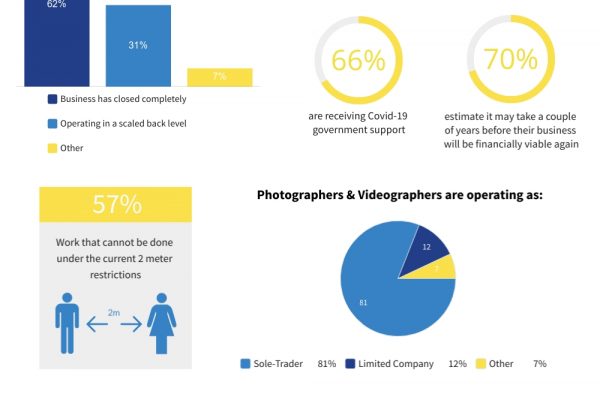

Irish photographer and videographer have been heavily impacted by Covid-19. With our work oriented heavily towards family and public gatherings i.e. weddings, concerts, family portraits, community events, it may take a considerable time before our businesses experience a sustainable recovery.

Since March, our professional organisation, the Irish Professional Photographers and Videographers Association (IPPVA), has been in contact with the Department of Business, Enterprise and Innovation, the Minister for Culture, Heritage and the Gaeltacht, and the Department of Employment Affairs and Social Protection on behalf of our members and the industry as a whole.

We worked hard to make sure the government acknowledged that some sectors, including ours, will be slower to recover than others and to seek a time extension on pandemic supports until such time as the sector can sustainably recover.

We have received some significant press coverage after conducting a national industry survey in May 2020.

Read more about the surveyGovernment Updates

Latest updates on COVID-19 (Coronavirus) From the Department of Health: https://www.gov.ie/en/news/7e0924-latest-updates-on-covid-19-coronavirus/

Latest Statutory Instruments: https://www.gov.ie/en/collection/1f150-view-statutory-instruments-related-to-the-covid-19-pandemic/

Supports available to businesses

Link to all government supports for COVID-19 impacted businesses

Employment Wage Subsidy Scheme: The Employment Wage Subsidy Scheme (EWSS), provides a flat-rate subsidy to qualifying employers based on the numbers of eligible employees on the employer’s payroll. The EWSS, operated by Revenue, has replaced the Temporary Wage Subsidy Scheme and will run until 31 March 2021.

COVID-19 Pandemic Unemployment Payment: The Pandemic Unemployment Payment is available to all employees and the self-employed who have lost their job due to the COVID-19 pandemic.

MyWelfare.ie is the quickest and easiest way to apply for payments.

COVID-19 Part-Time Job Incentive Scheme for the Self-Employed: If you are self-employed and were getting the COVID-19 Pandemic Unemployment Payment or a jobseeker’s payment, but you are returning to work, the COVID-19 Part Time Job Incentive for the Self-Employed is designed to support you. You can earn up to €480 gross over 4 weeks while receiving the COVID-19 Pandemic Unemployment Payment. However, if you are returning to work part-time (less than 24 hours per week) and earn more than this, you should apply for this scheme. Under the scheme, there is no income limit to your part-time earnings.

Short-time Work Support: Employees of businesses that need to reduce hours or days worked can avail of the Department of Employment Affairs and Social Protection Short-time Work Support.

COVID Restrictions Support Scheme: The COVID Restrictions Support Scheme (CRSS) offers support to businesses forced to close or trade at significantly reduced levels as a result of restrictions imposed on them in response to COVID-19. Eligible businesses can make a claim to Revenue for a payment known as an Advance Credit for Trading Expenses (ACTE). An ACTE is payable for each week a business is affected by the restrictions. The ACTE is equal to 10% of the average weekly turnover of the business in 2019 up to €20,000, plus 5% on turnover over €20,000. In the case of new businesses, the turnover is based on the average actual weekly turnover in 2020. The ACTE is subject to a maximum weekly payment of €5,000.

Enterprise Support Grant: The Enterprise Support Grant for businesses impacted by COVID-19 is available for eligible self-employed people who close their COVID-19 Pandemic Unemployment Payment on or 18 May 2020. This will provide business owners with a once-off grant of up to €1,000 to restart their business which was closed due to the COVID-19 pandemic.

Micro-Enterprise Assistance Fund: The new Micro-Enterprise Assistance Fund will help businesses with fewer than 10 employees, which are ineligible for existing grants, with a grant of up to €1,000 to help them adapt and invest to rebuild their business. The fund is administered by the Local Enterprise Offices.

Trading Online Voucher: The Local Enterprise Office Trading Online Voucher is a government grant scheme, designed to assist small businesses with up to 10 employees. It offers financial assistance of up to €2,500 along with training and advice to help your business trade online. Businesses that have already received a Trading Online Voucher can apply for a second voucher, where upgrades are required.

Useful links:

COVID 19 symptoms

https://www2.hse.ie/conditions/coronavirus/symptoms.html

Government Work Safely Protocol

https://enterprise.gov.ie/en/Publications/Publication-files/Work-Safely-Protocol.pdf

Resilience and Recovery 2020-2021: Plan for Living with COVID-19

https://www.gov.ie/en/publication/e5175-resilience-and-recovery-2020-2021-plan-for-living-with-covid-19/

EU Traffic Lights Approach to Travel

https://dfa.ie/travel/travel-advice/eu-traffic-lights-approach/

Hand Hygiene

https://www2.hse.ie/wellbeing/how-to-wash-your-hands.html

HSE guidance on masks and gloves

https://www2.hse.ie/conditions/coronavirus/face-masks-disposable-gloves.html

Guidance on safe use of face coverings

https://www.gov.ie/en/publication/aac74c-guidance-on-safe-use-of-face-coverings/

World Health Organisation Online Training

https://www.who.int/emergencies/diseases/novel-coronavirus-2019/training/online-training

HSE COVID 19 resources, posters, graphics

https://www.hse.ie/eng/services/news/newsfeatures/covid19-updates/partner-resources/

Covid 19 HSE updates

https://www.hse.ie/eng/services/news/newsfeatures/covid19-updates/

HSA Health and Safety Statement tool

https://www.besmart.ie/